The Cromford Report has some interesting data on the Phoenix real estate market as usual. While prices still appear to be “bumping along the bottom” ,and the existing median home sale price still remains around $110,000 where we’ve been since December 2010 , we are increasingly moving into a seller’s market territory. In a seller’s market buyer’s can expect fewer homes to choose from, and plenty of competition and multiple offer situations from other buyers fighting over the few houses that are available and hold good potential. We are now down to only about a 2.4 months supply inventory of homes, while a balanced market is usually in the 4-6 months supply inventory range (a lower number means demand is outpacing supply).

Key Points

· Supply continues to fall, though rather more slowly in the ranges above $200,000.

· Demand is very strong below $100,000 but is weakening above $100,000.

· Average sales price per sq. ft. is starting to look stronger below $100,000.

· Pricing is stable or slightly weaker over $200,000 with $400,000 to $800,000 looking strongest.

· A sharp deterioration in demand is now evident at the top end of the market.

· Foreclosure activity is still declining and REO inventory falling, especially at the lower price levels.

Overall

The situation in Greater Phoenix has reversed since the fourth quarter of 2010 when the bottom end was over-supplied and getting weaker. Now the strongest demand is below $100,000 and inventory levels are dropping fast. Although active listing counts continue to fall at all price levels, demand is declining above $100,000 and in particularly over $800,000. Overall average sales prices have shifted from the $83 to $84 per sq. ft. that we saw last month, down to $79 to $80 This is almost entirely due to a shift in the mix in favor of the lower end homes and away from expensive homes when sales are down sharply. The fact that median sales prices are unchanged tells us that it is a change in the blend rather than a fundamental price movement.

Foreclosures

New notices of foreclosure are running at their lowest level since 2007 and trustee sales are well down from the levles in March. We have fewer homes in foreclosure than at any time since the middle of 2008. Rumors abound that there is a new tidal wave of foreclosures coming. While I cannot comment on other parts of the county, in Phoenix I see no evidence to support that whatsoever.

Daily Market Snapshot

Full Market Summary

Although we didn’t see the record breaking sales numbers of June, July had plenty of positive news for market watchers. An important exception was pricing, and no doubt much will be made of that by the housing doom folks, but then Cromford Report readers all know that pricing is a trailing indicator, don’t we?

According to the current ARMLS data, 8,522 homes closed during July across all areas and types. This is 19.4% below the 10,568 we are measuring today for June. This dip between June and July is a normal seasonal effect. The key comparison to make is with July 2010. Here we are up 23.3% compared with 6,911 a clear sign that the market is healthier today than it was last year when we were reporting significant deterioration.

Due to the exceptionally large number of short sales in the ARMLS numbers, we experience a lot of “turbulence” in these sales numbers and they continue to change for many weeks after the end of the month. On July 2 last month we could see 3,057 short sales and pre-foreclosures across Greater Phoenix but this number is now measured at 2,481. The flexmls system automatically closes pending transactions when their Close of Escrow date is reached. Quite often a snag occurs in real life and a sale fails to close when expected and has to be manually reversed later. This is far more likely to happen with short sales than other types because of the large number of approvals and documents needed to successfully close escrow. As usual our sales counts will be constantly monitored and corrected as newer statistics emerge on a daily basis. The 19% drop-out rate for June is the highest we have seen and is unlikely to be repeated in July’s numbers, but please treat all reports with caution due to this effect.

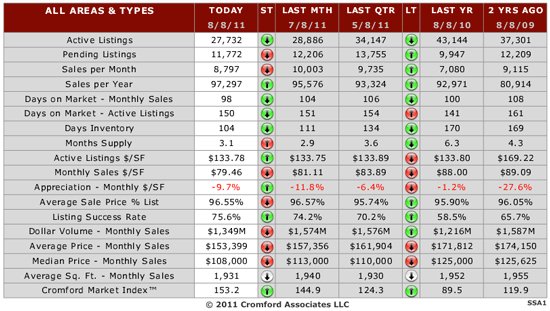

Here are some key figures for all areas & types:

Pending Listings: 11,491 on August 1, down 6% from 12,224 on July 1, but up 17% compared with August 1, 2010.

Active Listings: 27,787 on August 1, down 3.6% from 28,837 on July 1, and down 34.6% compared with August 1, 2010.

Listing Success Rate: 74.4% on August 1 which compares favorably with 73.5% on July 1 and very favorably with 58.5% on August 1, 2010.

In a normal year supply starts to increase from the beginning of July, so that 3.6% decline in active listings is a positive sign. Because of the lower monthly sales rate in July, months of supply has edged up from 2.9 to 3.0 months, but this is well below normal. The average months of supply for 2001 onwards is 5.8 months. A less volatile way to measure inventory is to divide active listings by the annual sales rate as this largely eliminates seasonal effects. Here we are seeing 105 days of inventory, improving from the 110 we measured last month and the lowest number of days of inventory since February 2006. The average days inventory since January 2001 is 174, so we have a significant under-supply of homes for sale through ARMLS.

Supply continues to drop while demand remains relatively strong. However that demand is not evenly distributed across the price ranges. In the last month we have seen the market strengthen at the low end while losing a lot of momentum at the middle and high end. Compared with July 2010, this month saw dramatic sales growth for single family homes below $100,000 but above that figure the picture is mixed. A few ranges performed fairly well, notably $100K->$125K, $175K->$200K, $400K->$500K and $1.5M->$2M, but there was a huge hole at the very top end of the market. Last year we had eleven closed sales over $3,000,000 during July and this July we have just one. Sales volumes are also down between $225K and $400K and between $600K and $1.5M. As you can imagine, an increase in the volumes under $100,000 pulls the average sales price and the average sales price per sq. ft. down substantially. The sales weakness in the higher range exacerbates this. However all that buying at the low end has caused the median sales price to stay fairly strong and it has barely changed over the last seven months.

As is normal when a market is attempting to recover from a long and disastrous plunge, there are plenty of conflicting signals:

Signs That Prices Are Going to Go Down

- The average list price per sq ft for pending listings continues to drift downwards, down 1.5% in the last month.

- The average asking price per sq. ft. for normal listings has fallen by 1.6% in the last month.

- Monthly average sales prices are making fresh lows.

Signs That Prices Are Going to Go Up

- The average asking price per sq. ft. for lender owned homes has risen by 7.4% in the last month.

- Sold price as a percentage of list continues to go up.

- Remarkably few listings are being canceled or expired.

- Investors are now purchasing nearly 40% of the properties auctioned at trustee sales in Maricopa County.

- Average days on market for closed sales is coming down.

Signs That Price Are Going to Stay Flat

- The average asking price per sq. ft. for short sales and pre-foreclosure has barely moved in the last month.

- Median sales prices are essentially flat.

So you can take your pick. It seems to me that although the supply/demand imbalance is becoming extreme, demand from investors alone is unlikely to sustain a significant upward price movement. We may have to wait until the general public realizes the degree to which the reality and perception of the supply picture have diverged, so that fear of missing out on a bargain overcomes the fear of prices dropping yet further.

There are still many sources claiming that a “new tidal wave of foreclosures” is going to hit the Phoenix area. This is pure imagination and reminds me of the Y2K phenomenon in 1999. Despite a busy final week in July, the trustees of Maricopa County only issued 4,194 new notices of which 4,015 were residential. This compares with 8,140 in total and 7,802 residential for July last year. Foreclosure notices are down 48% to the lowest level since December 2007. As for actual trustee sales, we had 3,330 in July of which 3,176 were residential. This is 31% down from July last year and 36% below March this year. The trend is obvious and strongly downward and it seems we are about 75% of the way through the foreclosure tsunami of 2007-2012. This observation is only made about Maricopa County and is probably not true elsewhere, especially in states that use a judicial foreclosure process.