The latest from The Cromford Report

Market Summary for the Beginning of August

The continued imbalance between high demand and low supply remains the main story for the Greater Phoenix residential market. After a strong move upward during the spring, prices remained relatively flat during June, as predicted last month. We expect to report something similar next month.

The increase in pricing has encouraged a few more sellers to enter the market, but as yet this is creating a modest increase in supply, almost indistinguishable from the usual seasonal increase we see between June and November each year. Increased prices and lack of supply has also dampened buyer enthusiasm, but more so for ordinary home buyers than for investors. Investor purchases are an increasing share of the market, particularly those bought by large companies as rental properties. In Greater Phoenix we have never seen so many single family homes used as rental accommodation and it will be interesting to see how elastic the demand is for such rental homes over the coming year. It is possible that landlords will need to lower their standards for tenants’ credit worthiness in order to keep homes occupied.

Most homes below $250,000 that are priced realistically are attracting a large number of offers within a short time, and offers will often exceed the asking price. It is still quieter in the luxury market and active adult sector where supply is adequate but now falling to levels that are below average. However the summer months are usually slow for these sectors as buyers wait for the cooler weather in October.

With the slow down in price increases, appraisals have had a chance to catch up, so appraisals are now coming in closer to current market value. However, the situation for the average home buyer remains dire despite extremely low interest rates and still-cheap prices by any historical standard. This is because the low number of homes for sale and large number of well-funded investors means any offer an ordinary home buyer makes is likely to have severe competition from multiple all-cash offers with few strings attached. Many ordinary buyers are coming away empty handed after submitting 10 or more offers.

This difficult situation is continuing to drive more potential home buyers to the developers’ sales offices. New builder subdivisions are very limited in number as existing ones have been closing-out faster than new ones have started up. New homes are not plentiful and build times are increasing as sales pick up. New home construction rates are also limited by the small skilled labor pool currently employed by trade subcontractors and by a dwindling supply of finished lots in builders’ hands.

The severe shortage of supply at the low end of the market is being relieved just a little. This relief is most evident in areas where price increases have been greatest (e.g. El Mirage, Maricopa, San Tan Valley, etc.). We are now entering the quieter half of the year, so demand will probably decline, especially from owner occupiers. This means the upward pressure on prices is likely to reduce, but it is unlikely to be eliminated.

As prices increase, returns on investment for landlords diminish and at some point in the future we expect to see investor demand diminish also. This will accelerate if vacancy rates start to increase. However there is still no sign of any significant new supply of homes coming on to the market and those who anticipate a flood of bank owned “shadow inventory” are likely to be very disappointed. For the short and medium term the market remains out of balance with an insufficient supply of homes to meet present demand.

Details:

Although supply remains low by normal standards, it has been creeping upwards since early June, while sales volume has been in decline. The significant fall in sales volume is partly due to restricted supply, but the third quarter is always a weaker time of year for ordinary home buyers. The market is certainly less frenetic than it was in the spring and the Cromford Market Index is gradually falling from its peak of 181.7 reached on April 22.

Let us look at the basic numbers for August 1, 2012 relative to August 1, 2011. For all areas & types across ARMLS we record the following:

- Active Listings (excluding AWC): 13,403 versus 20,196 last year – down 34%

- Active Listings (including AWC): 20,085 versus 27,787 last year – down 28%

- Pending Listings: 10,412 versus 11,491 last year – down 9%

- Monthly Sales: 7,112 versus 8,663 last year – down 18%

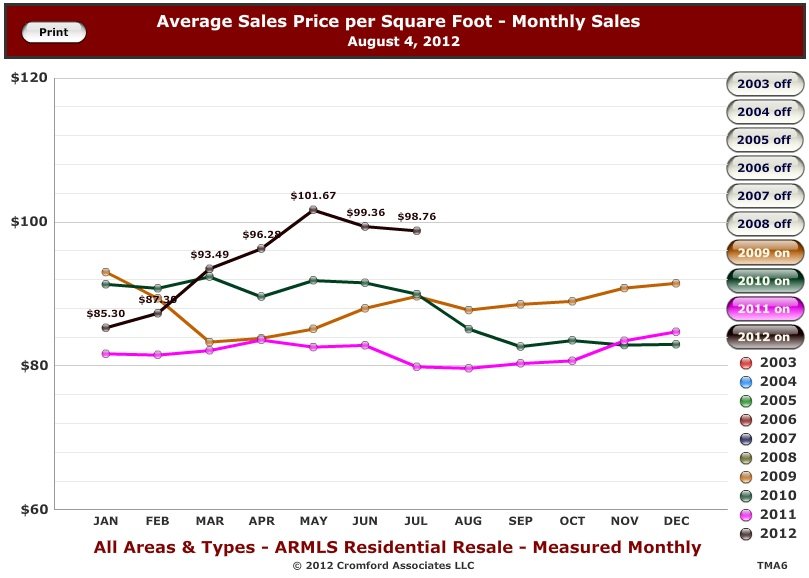

- Monthly Average Sales Price per Sq. Ft.: $98.54 versus $79.86 last year – up 23%

- Monthly Median Sales Price: $145,000 versus $109,000 last year – up 33%

Greater Phoenix REO sales dropped below 14% of the monthly total this morning, the first time this has occurred since January 4, 2008. At their peak on February 11, 2009, they constituted 71.1% of monthly sales. Although it will take some time for them to disappear completely, REOs are no longer a major factor in the market. Contrary to to the popular myth, there are not a lot of foreclosed homes in lenders’ possession, so we don’t expect this REO supply to increase.

In contrast, short sales comprised 31.4% of all sales in Greater Phoenix in July. this is even higher than the 29.3% we now measure for June 2012. With short sales selling for a lower average price per sq. ft. than REOs, this has a negative effect on average pricing over the last 2 months.

Normal sales have fallen from 56% to 54.6% of sales and their pricing is down from $116.82 to $115.62 per sq. ft.

The changing supply situation varies greatly by location. Cities with significant rises in single family active listings (excluding AWC) include El Mirage (up 194% since June 1, 2012), Arizona City (up 49%), Queen Creek (up 47%), Maricopa (up 43%), Anthem (up 38%), Avondale (up 32%), Casa Grande (up 31%), Florence (up 27%), Buckeye (up 25%), Tempe (up 25%), Mesa (up 25%), Glendale (up 23%), Goodyear (up 20%), Gilbert (up 19%) and Phoenix. However further falls in supply occurred in Gold Canyon (down 22%), Tolleson (down 19%), Sun City (down 19%), Sun Lakes (down 13%), Sun City West (down 11%), Laveen (down 9%), Fountain Hills (down 9%), Paradise Valley (down 8%), Scottsdale (down 7%), Cave Creek (down 5%), and Apache Junction (down 3%).

It is striking how accurately the average price per sq. ft. for under contract listings has foretold the monthly average sales price per sq. ft. The under contract average $/SF trend turned somewhat negative after April 27, while that for monthly sales $/SF followed suit on June 16.

Clearly we need to be watching the average $/SF for under contract listings to look for signs of the next big move in pricing.

The vast majority of housing analysts have revised their pricing forecasts upwards over the last 6 months. For example, Bank of America have changed their average price change for 2012 over 2011 to 2% from 0.5%. This is pretty modest, but it is for the entire country, so large advances in regions such as Arizona and California are offset by states who haven’t yet come to grips with their delinquency problem (e.g. Chicago, New York, etc.). In April and May we gently poked fun at Stan Humphreys, Chief Economist at Zillow for his tame forecast. He has since drastically revised his forecast from a 3.7% fall in 2012 to a 1.1% gain instead. Fannie Mae and Freddie Mac have also changed their forecasts from negative to positive price changes for 2012. The remaining bears include Gary Shilling, Fiserv & Moody’s Analytics. In 2011 Gary Shilling predicted a 20% drop in housing for 2012. The main cause for his wild miss on this occasion is that he misinterprets the housing inventory situation. However, to be fair, in the last 40 years I have yet to see or hear an optimistic forecast from Gary. The Moody’s and Fiserv house price forecasting models are fundamentally broken and extremely slow to react to changed market conditions. I don’t expect their forecasts to change much until the 2012 actual prices have been fed into their assumptions.