Market Summary for the Beginning of 2013 from The Cromford Report

Here are the basic ARMLS numbers for January 1, 2013 relative to January 1, 2012 for all areas & types:

- Active Listings (excluding AWC): 17,121 versus 18,221 last year – down 6.0% – and down 5.5% from 18,122 last month

- Active Listings (including AWC): 20,942 versus 24,788 last year – down 15.5% – and down 9.0% from 23,012 last month

- Pending Listings: 8,026 versus 9,086 last year – down 11.7% – and down 12.5% from 9,170 last month

- Monthly Sales: 7,069 versus 7,626 last year – down 7.3% – but up 3.7% from 6,820 last month

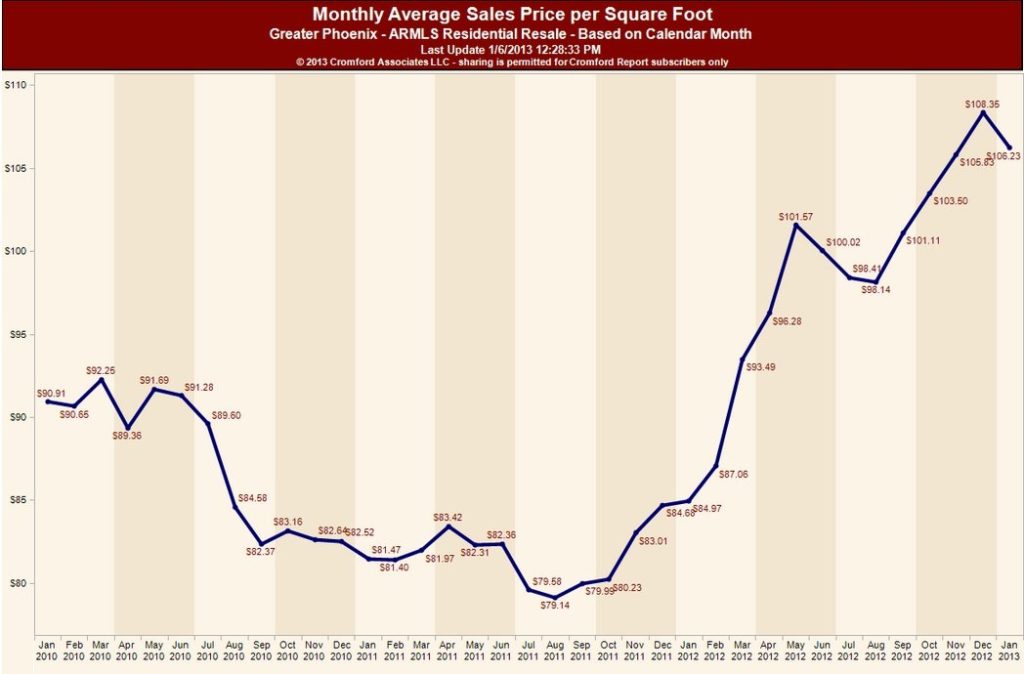

- Monthly Average Sales Price per Sq. Ft.: $107.66 versus $84.75 last year – up 27% – and up 1.6% from last month

- Monthly Median Sales Price: $153,000 versus $118,150 last year – up 28.7% – but down 1.9% from last month

We have reservations about the accuracy of the sales counts in that we suspect a few hundred of the short sales currently shown for December did not in fact get closed. These were closed automatically by ARMLS because the scheduled close date was reached. Those that did not actually close will probably have their status changed later as agents fix their listings. It is likely to be a couple of weeks before these numbers settle down. As we receive details from the county records we update our listings database with more accurate information, rather than relying exclusively on the ARMLS records.

The first half of December was dominated by strong sales of luxury homes while the last week saw a surge in lower end homes especially short sales. Pricing therefore surged upwards strongly by the third week of December only to drop sharply in the last few days.

Good news for sellers is that the Cromford Market Index™, having eased to a low point of 158.1 on December 3 is now rising again and has reached 166.0, its highest level since October 12. The Cromford Supply Index™ adjusts for seasonal effects and its move from 70.9 to 69.4 tells us that supply is getting tighter again, while the Cromford Demand Index™ is still moving gradually higher to 115.2, telling us that demand is getting slightly stronger.

At this point it is not clear what the active listing trend will be in coming months. We will certainly see some growth in January as many of the listings that expired at the end of December are re-submitted. The new listing counts were very weak for December but the sales numbers were nothing special either, so the message is inconclusive. We advise watching this number closely to determine how strong the market will be in the critical spring period. At the moment we see supply getting weaker in several mid-range areas while it recovers in some of the lowest cost areas. It would not be unreasonable to expect the recovery to affect the low end first (as it has), followed by the mid range and finally by the luxury sector.

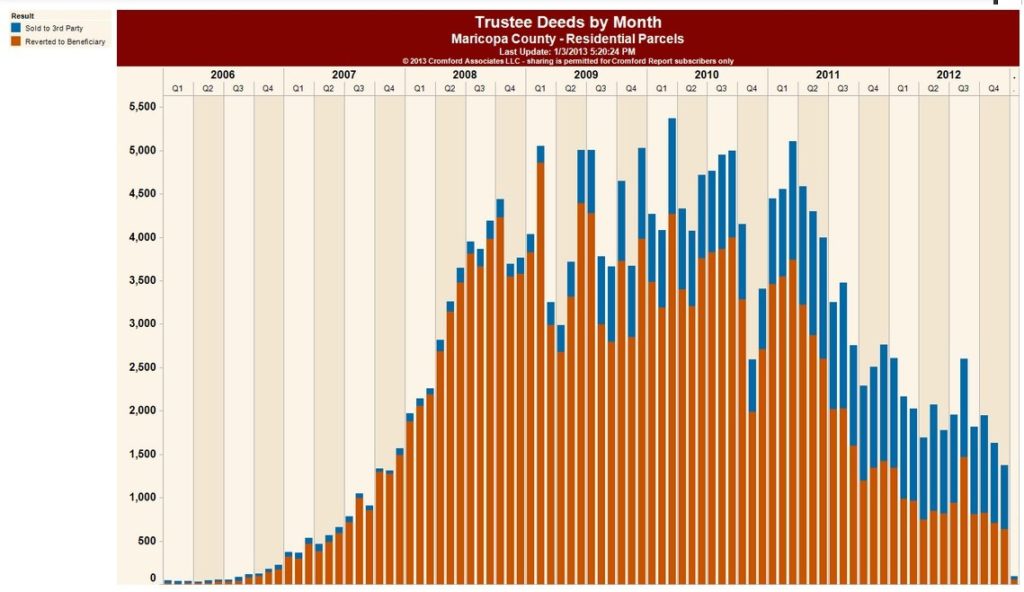

December was a bad month for people who like foreclosures. New Notices of Trustee Sale for Maricopa County came in at 2,112 in total which included 1,994 for residential properties. The last time we had fewer than 2,000 residential notices in a month was May 2007. Recorded Trustee Deeds totaled 1,399 of which 1,302 were residential. This is the lowest monthly number of Trustee Deeds since November 2007. As a sign of the times there were almost as many residential foreclosure notices canceled (1,881) as new ones filed (1,994). There were 8,758 residential notices active (i.e. pending foreclosures) as of January 1. This is 82% below the peak level of 47,606 in December 2009. Total distressed residential inventory (active notices plus REO) stands at 14,547, down 77% from the peak of 62,123 in February 2010. We are clearly almost at the end of the foreclosure wave in Greater Phoenix.

We expect to see overall $/SF pricing staying roughly flat in the immediate future as the pending $/SF has been levelling out. The odds are that an upward trend will resume shortly, given the continued imbalance between supply and demand..

In terms of public sentiment, the fiscal cliff agreement does not resolve too much since we still have the debt ceiling to worry about. The reversion to normal payroll taxes will reduce the net income of most working folks, which may dampen the housing market a little. On the other hand there is now so much positive news about housing in the media that public sentiment is likely to improve overall. It is possible that demand could strengthen quite a bit as a result, but the lenders can easily rain on that parade if they stick to their current underwriting principles. Despite the tempting low interest rates, actually obtaining full approval for a loan remains a process fraught with obstacles (not the least of which is the appraisal) and borrowers face unusually stringent documentation requirements.