Market Summary for the Beginning of June from The Cromford Report

May was another blow-out month for re-sale transactions, with very strong sales counts and dollar volume. Supply remains very constrained, but despite the big sales count we are starting to see a few signs of weakening demand. If the market can’t attain balance by strengthening supply it can do so by suppressing demand instead. This is not a change in market direction, just a natural cooling off as obstacles for buyers start to get harder to overcome.

Here are the basic ARMLS numbers for June 1, 2013 relative to June 1, 2012 for all areas & types:

- Active Listings (excluding UCB): 15,466 versus 12,491 last year – up 23.8% – but down 0.1% from 15,482 last month

- Active Listings (including UCB): 19,467 versus 19,977 last year – down 2.6% – and down 1.9% from 19,847 last month

- Pending Listings: 9,662 versus 11,656 last year – down 17.1% – and down 11.3% from 10,888 last month

- Monthly Sales: 9,316 versus 8,439 last year – up 10.4% – and up 4.3% from 8,963 last month

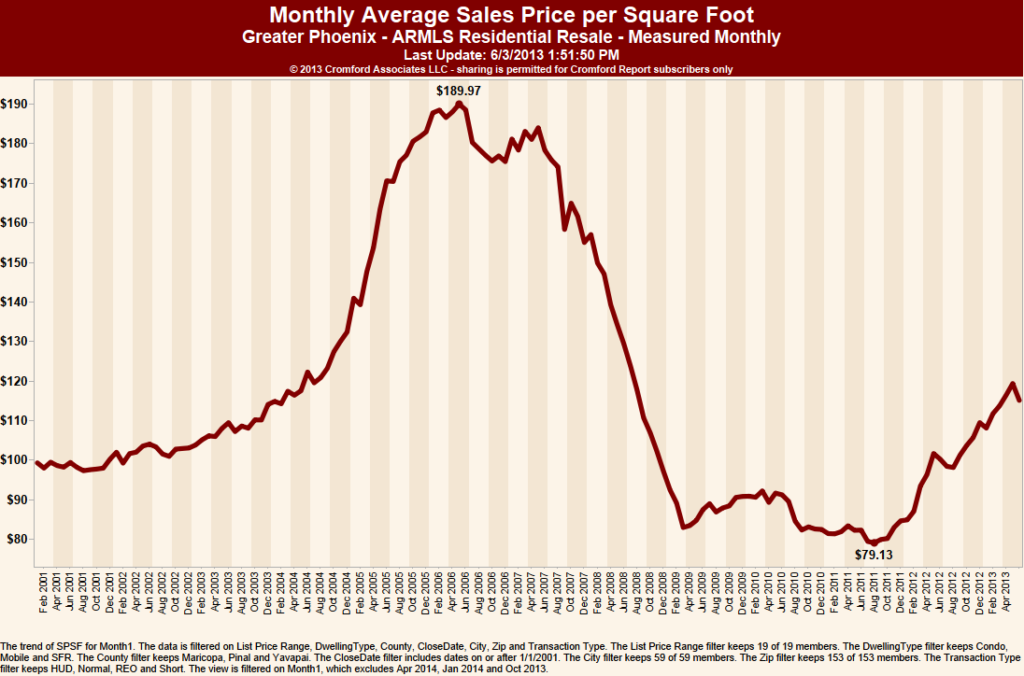

- Monthly Average Sales Price per Sq. Ft.: $119.40 versus $101.85 last year – up 17% – and up 2.5% from last month

- Monthly Median Sales Price: $175,000 versus $145,000 last year – up 20.7% – and up 1.7% from last month

This May was the strongest month for sales since June 2011, with ARMLS 9,183 sales in Greater Phoenix (plus 133 out of territory). Of these

- 192 were HUD sales

- 699 were REO sales

- 1,228 were short sales

- 7,064 were normal sales

That is the largest number of normal sales in a month since May 2006 at the height of the housing bubble. This is also the second month in a row we have seen year over year growth in the total monthly sales rate, after observing lower sales rates between March 2012 and March 2013. The annual sales rate is now on a rising trend. We still have just 2.3 months of supply, including UCB listings. If we exclude those UCB listings we have only 1.7 months of supply.

The average days on market for monthly sales is down to 67 days from 84 last year. However the average days on market for active listings is still up at 114, which tells us that the inventory of active listings contains a lot of homes that are undesirable or over-priced. Attractive homes at realistic prices are few and far between and usually last only a few days before they go under contract.

The dollar volume for May was over $2.2 million. 28.8% higher than last year and as high as in July 2006. This is obviously good news for realtors and their commissions.

The number of new listings being added has been slightly higher than last year for the past three months, but in most areas it is not enough to replace listings going under contract or getting cancelled or expired. With the change of season from spring to summer this will probably change and we expect the number of active listings to start rising, peaking in late November. This is just a normal seasonal pattern. We will watch for this trend to see if it is stronger or weaker than normal.

The appreciation rate has dropped to 17% because prices were rising faster last year than they are now. We saw a 2.5% rise during May, equivalent to what we should expect to see in a whole year if supply and demand were in balance. We expect little to no increase in June and our short term outlook is for pricing to remain in a tight range around $120 per sq. ft. for the next couple of months.

The count of pending listings dropped by over 11% between May 1 and June 1 and this is one of the highest declines we have seen except for 2010 (which was exceptional and caused by the expiry of the tax credit). Under contract totals also dropped sharply to 13,663 from 15,253. It is a little early to jump to conclusions, but we suspect that the combination of stiff competition, rising interest rates and rising prices are taking the wind out of some buyer’s sails. Given the shortage of supply this will have little effect on market balance at first but if this trend develops further we may end up with demand well below average in order to match the supply which is already far below average. If this happens pricing pressure will eventually be reduced to the rate of inflation. The Cromford Supply Index™ is still down at only 62.5 while the Cromford Demand Index™ has fallen below 102 for the first time since January 2009. This leaves the Cromford Market Index™ still at a high 163 but with a slow downward trend.

There are now lots of indicators to watch to see where the market goes next.