Market data for the beginning of September from The Cromford Report’s shows more encouraging signs. It shows a slight softening in demand and pricing in the middle and upper end of the market, but increasing demand and price stabilization in the lower end. We always have to look at things on both a macro and micro scale when considering real estate market values, as there can be large differences in the balance of supply and demand depending on the price range or location

The most telling statistic that prices (barring a big downward shift in the economy) should not be going down significantly anytime soon, is going back to the basic laws of supply and demand…the supply level of inventory we have compared to the level of buying activity in the market. Total active listings are down by nearly 50% from this time last year! Pending sales are up 17% compared to this time last year. Although prices are lower year over year from 2010, the market environment today is getting pretty competitive with demand high above normal and supply well below normal. Just as some thought prices could never go down while in the past bubble, many are feeling prices can never go up now. Once the general public, mainstream media, appraisers, and the financial institutions catch on to signs of stabilization in our market, prices may bounce back with a vengeance.

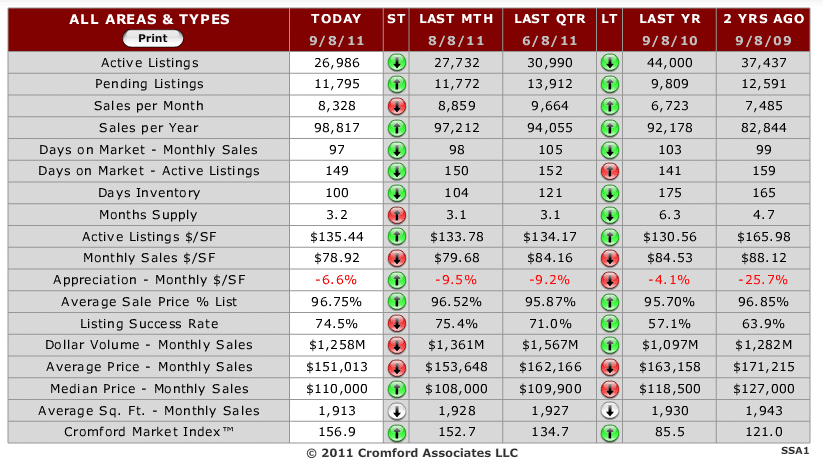

CROMFORD REPORT

August was similar to July but different from the first half of 2011. Apparently spooked by the debt crisis and the corresponding turmoil in the stock market, the middle and upper end of the market went quiet in July and August, especially for homes over $2,000,000, but the demand for homes under $100,000 continued to go from strength to strength and supply is now very low in several of the lower priced locations.

Looking into the ARMLS data across all areas and types we see the following:

Sales per Month: 8,734 in August – up nearly 3% from July and up 26.5% from this time last year.

Active Listings (including AWC): 26,820 on September 1 – down 3.5% from August 1 and down 37% from this time last year.

Active Listings (excluding AWC): 19,216 on September 1 – down 4.8% from August 1 and down 47% from this time last year.

Pending Sales: 11,508 on September 1, up 0.2% from August 1, and up 17% compared with this time last year.

Listing Success Rate: 74.4% on September 1 – almost the same as on August 1 and up significantly from 57.5% on September 1, 2010.

Contract Ratio: 99.5 on September 1, up from 94.5 on August 1 and 41.3 last year at this time.

Days Inventory: 99 on September 1, down from 105 on August 1 and 172 at this time last year

Cromford Market Index™: 155.6 on September 1, up from 151.5 on August 1 and 85.5 on September 1, 2010.

Sales Price as a Percentage of List: 96.79% on September 1, up from 96.55% on August 1 and 95.75% on September 1, 2010

Please don’t waste time looking for negative signals among these numbers. There aren’t any.

The numbers say the market is in very good shape with demand far outstripping supply. However most potential homeowners (understandably) would disagree. Normal home buyers tend to pay far more attention to their emotions than local housing market data. Most people are still experiencing too much fear to consider home ownership or upgrading, with an uncertain economy, poor employment statistics and the psychology of crowds discouraging them from taking advantage of the lowest pricing in over a decade, even with low interest rates as the icing on the cake. In addition we have some very real factors keeping pricing down. Appraisals are almost universally conservative, often coming in lower than the buyer is willing to pay. Lending is highly constrained by extremely cautious underwriting. A large number of homeowners have negative equity putting a damper on their financial plans. In fact almost everything is the exact opposite of the first half of 2006, when the numbers indicated clearly that the market was headed for disaster but nobody paid any attention. Then we could see appraisals supporting ever increasing prices, lending policies were more relaxed than ever and everybody seemed to believe that prices could only go up. Indeed they believed this right up to the point of collapse.

Now it seems to be popular to believe that prices will fall further. Indeed with the current negative sentiment it is certainly possible they may fall a little further for a short while, especially if the upper end of the market stays quiet. However it is also inevitable that they will at some point increase from the current level and the market statistics indicate that this may be sooner than most people think. When demand is well above normal and supply is well below normal, prices cannot fall indefinitely. In the past the laws of supply and demand have only been ignored for about 18 months at maximum. Then we have seen them cut in with a vengeance. We have gone 9 months so far with the market indicators and pricing going in opposite directions.

So where is pricing now?

The lowest point so far for the monthly average sales price on ARMLS is $150,448 on August 25. The lowest point for the overall monthly average $/SF is $78.79, also on August 25. We are currently very slightly above that low point and drifting aimlessly.

The lowest point so far for overall monthly median sales price is $107,000 reached on February 22, with August 9, 17 and 18 all matching that level. We are currently above that low point – back around $110,000 with no clear sign of direction.

The pricing averages are lower than February but the medians are not. This is caused by the relative weakness of the mid to high end market, a weakness which drags the averages down but has only marginal effect on medians.

In contrast to the spring, prices are now falling at the higher end of the market. The lower end has achieved stability in sales pricing while asking prices are strongly rising and pending prices are showing early signs of increases in certain markets. Competition among landlords for good rental homes is extremely strong and the markets in their favorite locations are very active. This is also reflected in prices paid at trustee sales. which are more competitive now than at any time since 2005. El Mirage, Maricopa, Tolleson, Avondale, all have extremely low levels of inventory, so low that sales volumes are now being affected. The number of lender owned homes for sale in many of these areas is a tiny fraction of the peak level of the winter of 2008/2009. In fact a comparison of REO single family home inventory in January 2009 and September 2011 is very revealing:

| City | REOs Active Now | REOs Active Jan 2009 | Change |

| El Mirage | 22 | 295 | -93% |

| Avondale | 41 | 518 | -92% |

| Maricopa | 36 | 437 | -92% |

| Youngtown | 4 | 49 | -92% |

| Tolleson | 26 | 247 | -89% |

| Tonopah | 3 | 27 | -89% |

| Anthem | 9 | 66 | -86% |

| Carefree | 1 | 7 | -86% |

| Wittmann | 6 | 42 | -86% |

| Queen Creek | 87 | 569 | -85% |

| Buckeye | 83 | 498 | -83% |

| Phoenix | 765 | 4544 | -83% |

| Apache Junction | 30 | 152 | -80% |

| Glendale | 175 | 882 | -80% |

| Coolidge | 15 | 76 | -80% |

| Goodyear | 66 | 311 | -79% |

| Litchfield Park | 26 | 120 | -78% |

| Peoria | 109 | 474 | -77% |

| Casa Grande | 34 | 147 | -77% |

| Surprise | 135 | 541 | -75% |

| Mesa | 255 | 946 | -73% |

| Arizona City | 20 | 74 | -73% |

| Eloy | 6 | 22 | -73% |

| Laveen | 59 | 199 | -70% |

| Florence | 26 | 81 | -68% |

| Fountain Hills | 15 | 46 | -67% |

| Gilbert | 144 | 393 | -63% |

| New River | 14 | 36 | -61% |

| Chandler | 130 | 329 | -60% |

| Scottsdale | 120 | 284 | -58% |

| Gold Canyon | 16 | 37 | -57% |

| Cave Creek | 22 | 50 | -56% |

| Waddell | 17 | 33 | -49% |

| Tempe | 45 | 70 | -36% |

| Paradise Valley | 8 | 12 | -33% |

| Sun City | 48 | 50 | -4% |

| Sun City West | 19 | 16 | +19% |

| Wickenburg | 15 | 8 | +87% |

| Rio Verde | 6 | 3 | +100% |

| Sun Lakes | 6 | 3 | +100% |

Please go ahead and show this table to those who still talk of a “huge glut of foreclosed homes for sale”.

Note that the areas most affected by the foreclosure tsunami are also the ones that have had the biggest declines in lender owned inventory between 2009 and now. El Mirage used to have more REOs than the much larger city of Scottsdale. Now it has only 18% of Scottsdale’s inventory.

Maricopa County Foreclosures in August:

New notices increased by 27% over July. Some of this increases was due to the fact that August had 23 working days whereas July had only 20, but we are definitely seeing a few signs of borrowers getting into more difficulty as the economy sputters. However we must put the August count of 5,318 notices into context. It is lower than every month between March 2008 and January 2011 and so only looks bad because of the low counts between April and July.

The daily rate of trustee sales declined again but because August had more days than July, the monthly total of trustee deeds for August was 3,581, up 8% over July. However in August 2010 we had 5,015 so we are down 29% year on year.

At the trustee sales in August, 42% of the properties were purchased by third parties, setting a new record of 1,510 third party purchases.