Market Summary for the Beginning of March from the Cromford Report

Here are the basic ARMLS numbers for March 1, 2013 relative to March 1, 2012 for all areas & types:

- Active Listings (excluding UCB): 17,090 versus 16,026 last year – up 6.6% – but down 2.7% from 17,573 last month

- Active Listings (including UCB): 21,599 versus 23,511 last year – down 8.7% – and down 1.4% from 21,757 last month

- Pending Listings: 10,300 versus 11,693 last year – down 11.9% – but up 8.2% from 9,523 last month

- Monthly Sales: 6,521 versus 7,296 last year – down 10.6% – but up 7.9% from 6,041 last month

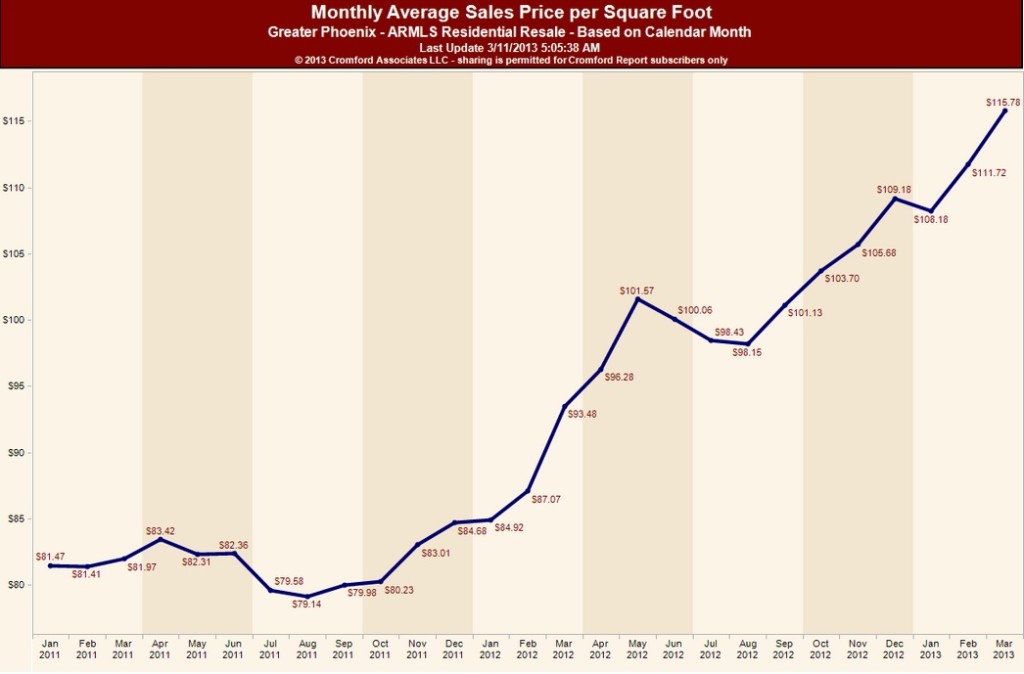

- Monthly Average Sales Price per Sq. Ft.: $111.33 versus $87.32 last year – up 28% – and up 3.0% from last month

- Monthly Median Sales Price: $160,000 versus $122,000 last year – up 31% – and up 3.3% from last month

Just like February 2012, prices shot up at the end of the month. This should not have been a surprise given the remarkable increase in the average $/SF for pending listings. A lot of high priced homes closed escrow on February 28th. This caused the pending $/SF to drop and the sales $/SF to jump. However the pending $/SF has swiftly recovered suggesting more price rises are on the way. NAR recently reported that pending listings were strong for the nation as a whole. Not so here. The pending volume of 10,300 is the weakest number for the beginning of March since 2009. But then Phoenix has not been following the national trends for many months.

Sales remain weaker, down 10.6% from last year. This is a result of the low number of bank-owned and short sale homes available. Normal sales across Greater Phoenix were 34% higher than in February 2012. However lender owned sales in Greater Phoenix were down 47% and short sales and pre-foreclosures were also down 47%. Though down from 2012 and 2011, February 2013’s sales exceeded all earlier years except for 2005. Demand is well off its highs but remains above normal.

Supply remains very weak, but not as tight as this time last year when active listing counts were dropping fast. The mix of active listing (excluding UCB) has changed a lot compared with March 2012. Within Greater Phoenix:

- Normal listings – up 19.1%

- Lender owned listings – down 15.3%

- Short sale listings – down 46.4%

Prices have been climbing extremely fast over the last year, with distinct pauses during the third quarter and holiday season. However the change in the mix of both supply and sales has exaggerated and amplified the underlying change in home values.

Normal sales took a 71% market share in February (the highest since February 2008) with short sales at 16% and REOs at 14%. This represents a decrease in the REO market share from 16% in January, as we predicted last month. Short sales are also dropping, down from 18% in January and now at the lowest percentage since August 2009.

The shortage in supply remains concentrated in price ranges below $225,000, where things are getting worse for buyers. Between $225,000 and $500,000 supply is low but stable. Above $500,000, supply is recovering and at the top ranges over $2,000,000 supply is plentiful and now increasing.

New home builders have increased production but not to anything approaching a level that can make much difference to the overall tight supply situation. They are not even at one third of the production levels they were at 15 years ago. Having been burned badly by overbuilding in 2004 through 2006 they are not about to risk over-building again in a hurry.

The only remaining solution is for prices to rise – this encourages more sellers to list their homes and discourages buyers, especially investors, who are gently slowing down their activity. New homes prices are going to rise anyway. Labor costs are rising due to the shortage of construction workers. Materials costs have been rising at an unusual rate and land costs have been rising even faster. The increase in new home prices will create a vacuum for resale homes to move into. Buyers hoping and waiting for prices to drop back from 2012 levels are likely to be very disappointed. Their disappointment may turn to extreme frustration as price rises of at least 10% seem likely between February and June this year. No relief for buyers is yet in sight.