November 2020 Market Update courtesy of Cromford Report

— Demand for Homes Up 36%!

— Rents up 17% Since April!

Here are the basics for November 1, 2020 compared with November 1, 2019 for all areas & types:

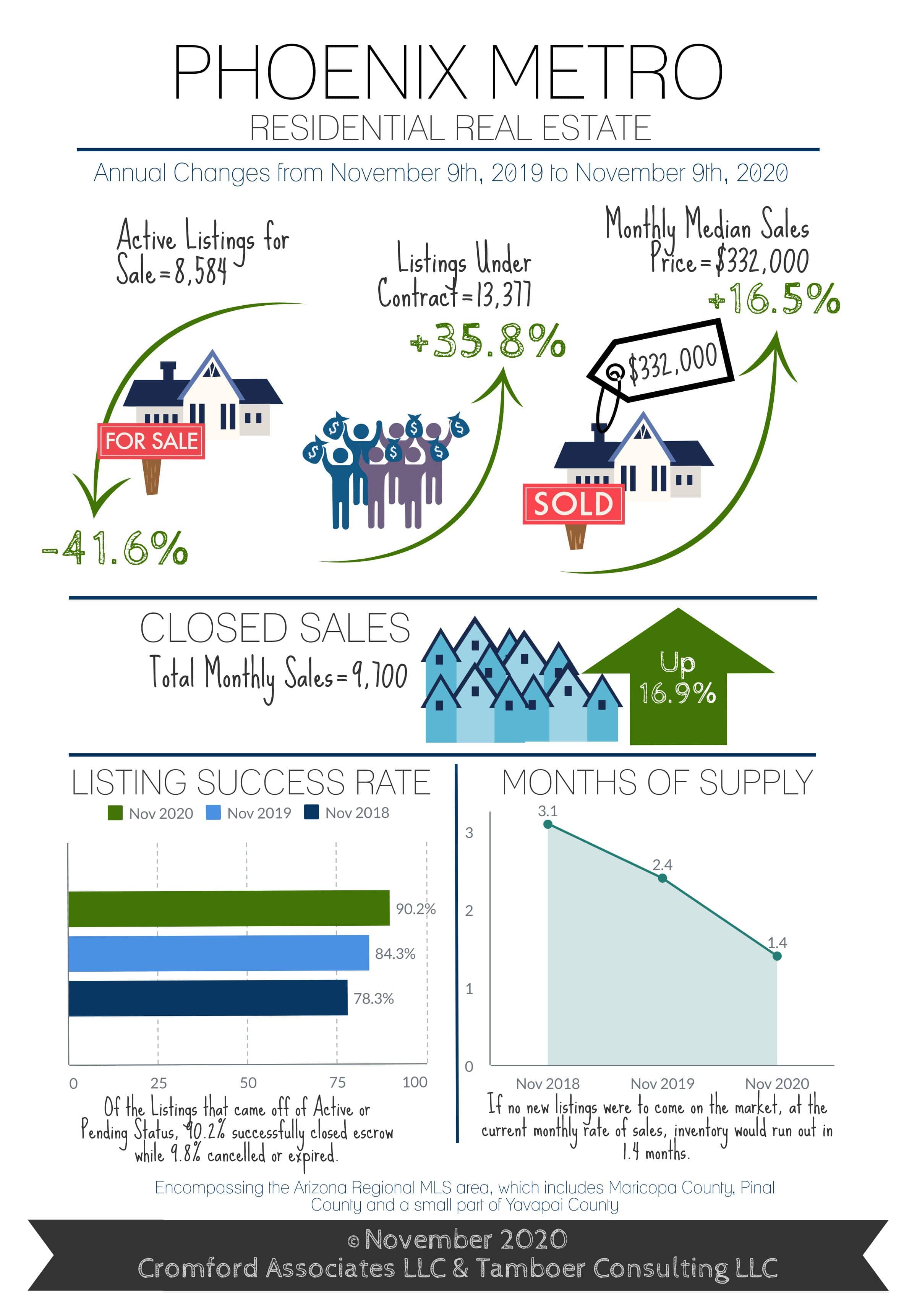

- Active Listings: 8,682 versus 14,525 last year – down 40.2% – but up 7.4% from 8,101 last month

- Under Contract Listings: 13,081 versus 9,716 last year – up 34.6% – but down 0.9% from 13,203 last month

- Monthly Sales: 9,992 versus 8,037 last year – up 20.5% – and up 3.6% from 9,641 last month

- Monthly Average Sales Price per Sq. Ft.: $207.37 versus $174.14 last year – up 19.1% – and up 4.3% from $198.84 last month

- Monthly Median Sales Price: $332,000 versus $285,000 last year – up 16.5% – and up 1.6% from $326,800 last month

The flow of new listings remained strong until late October but has started to fade noticeably over the last week. Since we are already very short of supply, this does not bode well for buyers who are likely to be fighting each other over a dwindling list of homes for sale during the last 2 months of the year. With demand at a very high level, especially for the normally quiet fourth quarter, the market is even more out of balance than it was last month.

Closed sales were over 20% higher than in 2019 during October. This is even more remarkable given that in 2019 October had 23 working days, 1 more than in 2020. With the average price per square foot up over 19% from last year, the dollar volume is exceptionally high at $4,272 million, up from $2,786 million last year. And last year we thought we had a strong market. We are running out of superlatives to describe the state of the current market.

Average and median prices are running away skywards, but some of this is fuelled by a sales mix which increasingly favors upscale properties. During October we saw 37 closed listings over $3 million. This is not only the highest total for any October in history, it is the highest total for any month in history. The average for all months since 2001 is 9 and in October 2019 we counted 10.

The size of the market below $300,000 is shrinking fast, constrained by lack of supply and by the fact that last year’s home at $270,000 is now priced well over $300,000. However any home priced under $300,000 is likely to see hordes of buyers.

Is there any sign of the upward surge in pricing losing pace? In a word – No.

At this time last year we had no idea of the impending pandemic, but unless something similarly surprising happens in the next few months, the housing market in Greater Phoenix is unlikely to stop rising.

For Buyers:

The Rent vs. Buy scenario has become heavily in favor of buying over the last 5 months. Eviction moratoriums due to the pandemic have greatly reduced turnover rates in a rental market that is already short of supply. Lease rates on listings through the Arizona Regional MLS have increased 17% since April overall; and for a home between 1,500-2,000 sf the median lease price in the 4th Quarter is $1,850 a month, up a whopping $255 from the 4th Quarter last year.

While leases have been rising, home values have also risen 16%; however declining interest rates have kept the monthly payments level. The median sales price for a 1,500-2,000sf home is currently $316,000, up $27,000 since April. Despite this 9% increase (assuming a $15,000-$30,000 investment and interest rate under 3%), purchasing a home could possibly save a renter hundreds of dollars on their monthly budget while simultaneously building equity and ensuring a level of stability in their housing cost.

For Sellers:

While many people are waiting for the final results of the 2020 election, at least one thing is for certain in Greater Phoenix. The housing market will not crash in 2021 regardless of the outcome. It may be hard to believe, but the new and resale housing markets don’t move quickly. Unlike the stock market where it takes a push of a button to sell a stock and record the price, it takes longer to sell a home between the marketing time and escrow process. In today’s market, it may take up to a week to negotiate an offer and another 30-45 days for the price to be publicly recorded. When a market weakens, it takes longer.

Supply in Greater Phoenix has been gradually shrinking for 6 years and was the driver behind price appreciation until the pandemic. To put things in perspective, the Arizona Regional MLS should seasonally have between 25,000-30,000 listings active at this time of year; as of November 9th there are under 8,600. That type of shortage doesn’t happen overnight and new construction will not be able to fill the gap quickly.

Listings Under Contract should seasonally have between 9,000-10,000 in escrow at this time of year; as of November 9th there are over 13,000. This level was reached in June and has stayed consistent for nearly 5 months. Even if demand were to scale back in 2021 and return to a normal level, the market would not see a massive drop in prices; just a slowing in appreciation.

©2020 Cromford Associates LLC and Tamboer Consulting LLC