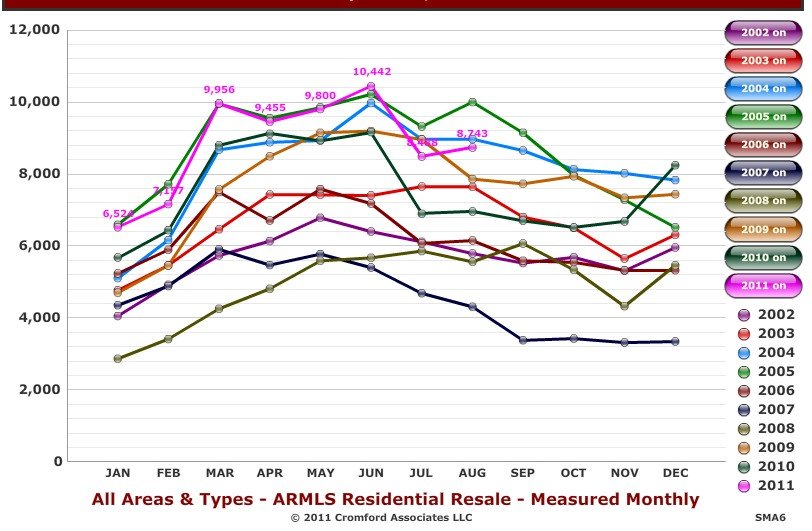

The latest data from The Cromford Report just released shows sales volume dropping in September, but still up 17% over last year with a total of 7,832 homes sold this year. Supply levels are holding steady for the first time since December 2010, up 0.6% from last month but a massive drop of 50% from this time last year of available homes to choose from on the market. The monthly drop in number of homes sold is nothing unusual, as it is a typical season trend in the Phoenix area, as seen below.

Compared to the last 10 years, 2011 is shaping up to the second busiest year for home sales with only the peak boom year of 2005 recording more homes sold. For anyone who has bought or is looking for a home recently, you’re not the only one out there.

The most encouraging piece of data we are seeing is the pending $/SF changing direction, appreciating upward after trending downward for a prolonged 15 month period since May 2010. The monthly median sales price for existing homes is also encouraging news with a price of $115,000, up from $110,000 last month, reinforcing evidence of a stable base in median sale price ranging from $110,000-$115,000 since December 2010. Hopefully all of these positive trends continue in the Phoenix area, and they likely should continue, unless we have a massive change in either demand or supply in our future caused by shocks to what some are calling a fragile economy.

Market Summary for the Beginning of October from the Cromford Report

Sales volumes dropped in September while supply failed to decline for the first time since December 2010. To compensate we saw positive pricing movement for the first time since the second quarter.

Looking into the ARMLS data across all areas and types we see the following:

Sales per Month: 7,832 in September – down 11% from August but up 17% from this time last year.

Active Listings (including AWC): 26,869 on October 1 – up 0.2% from September 1 but down 40% from this time last year.

Active Listings (excluding AWC): 19,327 on October 1 – up 0.6% from September 1 but down 50% from this time last year.

Pending Sales: 10,841 on October 1, down 5.8% from August 1, but up 12.4% compared with this time last year.

Listing Success Rate: 75.7% on October 1 – up from 74.5% on September 1 and up significantly from 56.9% on October 1, 2010.

Contract Ratio: 95.2 on October 1, down from 99.5 on September 1 but dramatically up from 40.0 last year at this time.

Days Inventory: 99 on October 1, the same as September 1 but dramatically down from 179 at this time last year

Cromford Market Index™: 159.3 on October 1, up from 155.6 on September 1 and 85.4 on October 1, 2010.

Sales Price as a Percentage of List: 96.70% on October 1, almost the same as 96.72% on September 1 but up from 95.43% on October 1, 2010

We can see that all these numbers are far better than 12 months ago but most are not as good as last month. However the Cromford Report Index™ continued to improve. This is because this index is a seasonally adjusted measure and it is normal for inventory to increase between September and October. In fact the inventory increased only 0.2%, far less than in an average year and causing most of the improvement in the index.

It is also normal for sales volume and pending listings to decline between September and October. This year sales volumes fell faster than pending sales, which is partly due to the decline in REO listings. With fewer lender-owned and HUD properties available, last year’s sales volume for REOs is no longer sustainable. We now see demand in slight decline and expect to see the Cromford Market Index™ fall back from its recent highs as a result.

REOs are losing market share very quickly now. Fewer trustee sales are taking place. There were 2,689 residential trustee sales in Maricopa County during September 2011, 44% fewer than the 4,808 of September 2010. In addition a larger percentage of these auctions are now won by third parties (42% in September 2011 versus 20% a year ago). So the quantity of homes reverting to the beneficiary is dropping extremely fast. Only 1,280 single family homes went back to the lenders in Maricopa County in September 2011. This is the lowest total since November 2007. It is also 61% lower than the 3,289 that they received in September 2010. They are selling far more than this number through ARMLS each month and so the lenders’ inventory is being rapidly depleted.

It is a clear sign of the strength and dominance of negative sentiment that this remarkable turn round is mostly overlooked. At the same time, a completely irrelevant increase in foreclosures between July and August (due entirely to August having 23 trustee sale days instead of July’s 20) managed to make headlines in the local papers. When bad news is amplified like this and good news is ignored we know sentiment has swung too far.

For the housing doom fans who like foreclosures, September 2011 was a pretty dismal month. There were a total of 4,544 new notices issued in Maricopa County of which 4,335 were residential. This is 39% lower than September 2010. This new number is actually slightly higher than April through July 2011, but 15% lower than last month and lower than every month prior to April until we get all the way back to December 2007. The downward trend has slowed but remains in place. The bigger news is that there were only 2,840 trustee sales of all property types. This is 44% down from September 2010. This is also the lowest number since March 2008 (except for November 2010 when Bank of America completely halted its trustee sales). Foreclosures are clearly well past their peak and the short sale is looking likely to overtake the foreclosure in the coming months as the primary mechanism to resolve homeowners’ financial distress.

Pricing

After hitting a low point in late August and again in mid September, pricing is on a slight upward trend again. The monthly median sales price has climbed from $107,000 on August 18 to $114,950 on October 3 (all areas & types). That’s a 7.4% increase in less than 7 weeks and illustrates how violently the monthly median sales price reacts when REOs start disappearing from the mix and increasing in price at the same time. For Greater Phoenix REOs the monthly median sales price has jumped from $80,000 to $86,400 in the same period, an 8% increase. Pricing for short sales and foreclosures has not followed suit and neither have sales prices for normal sales. In fact pricing has been a little weaker at the higher price points cancelling out some of the gains at the bottom of the market. The overall average price per sq. ft. is up only modestly. Having hit a decade low of $78.51 per sq. ft on September 15, we are now looking at $79.81 per sq. ft. for October 3, a bounce but not a very convincing one. The most encouraging sign is that the pending $/SF has finally started to change direction and is moving up again after trending downward for a prolonged 15 month period since May 2010. We wait with bated breath to see if it can keep this up throughout October.